Step 7: Paying for Your Wheels

Can you afford to pay for your dream car(s)? For the sake of this project, you are able to put a $4,000 down payment on your car on top of any trade in/private sale you may have.

Information will go on your Family Budget Presentation AND Google Budget Sheet.

- What is your monthly carpayment going to be? Go to http://www.bankrate.com/calculators/auto/auto-loan-calculator.aspx.

Important: You using this loan calculator just to get the current interest rate information.

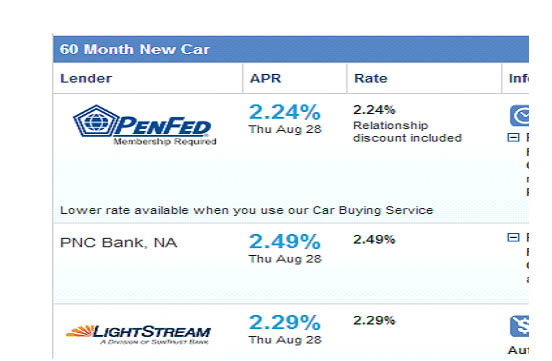

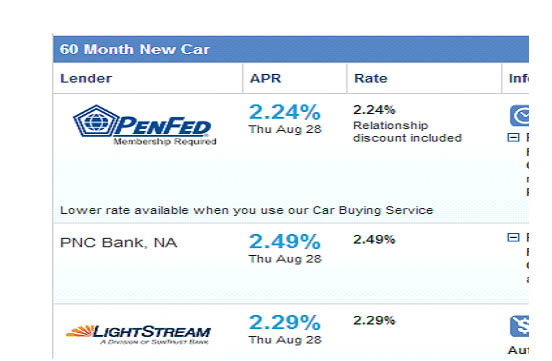

- Go to the “Auto Loan Rates Averages Box” and click on “60 Month” in the “compare auto loan rates” box for either a new or used car (depending on what you are buying).

- Put in the zip code of your new home and make sure 60 month new or used is clicked (depending on the type of car you are buying).

- Fortunately, you have a great credit rating so you can use the lowest interest rate.

- Take a screenshot of the interest rates for your Family Budget Report document.

- Look at the chart located at: http://www.taxadmin.org/fta/rate/sales.pdf and record the sales tax for the state you plan on living in. Please get a screenshot of the sales tax line for your state.

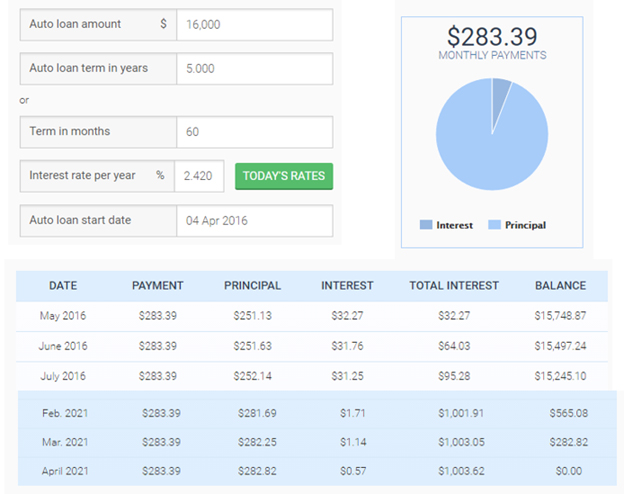

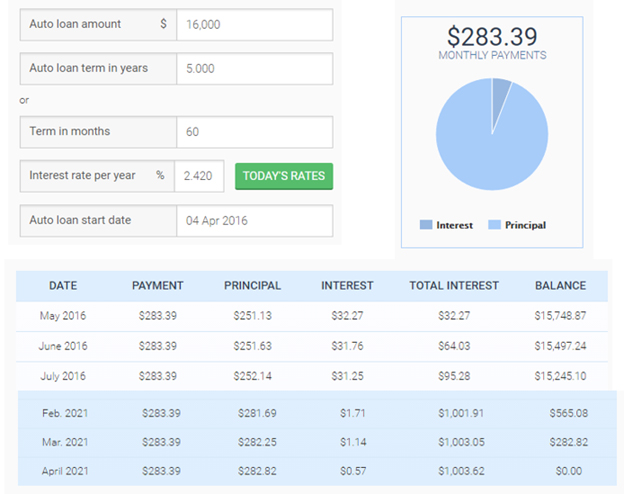

- How expensive is this car going to be? Go to http://www.bankrate.com/calculators/auto/auto-loan-calculator.aspx.

- The “Loan Amount” is the “TMV what others are paying” price.

- Enter the full price of the car, down payment ($4,000), Trade in Amount (If applicable), Interest Rate, Loan Term of 5 years, and sales tax for your state. Click calculate.

- Get a screenshot of ”Your Loan Information”, “Loan Summary” and “Yearly Amortization Schedule”.

- Note: Does your partner need a car? Have your partner complete the process to buy another car.

- Share the monthly payment information, combine, and record the monthly payment amounts in the space provided on your Family Budge Presentation AND your Google Budget Sheet.

|

|